does tennessee have estate or inheritance tax

Tennessee is an inheritance tax and estate tax-free state. Tennessee is not impose an estate tax.

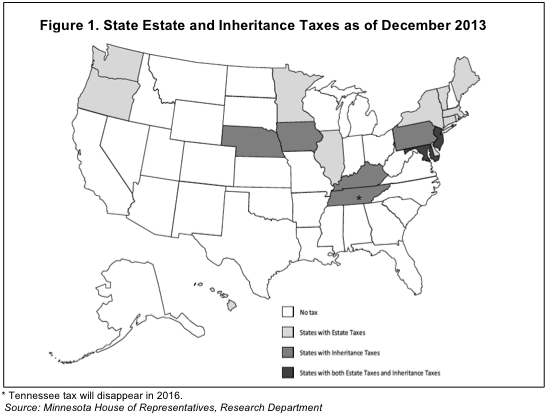

Estate And Inheritance Taxes Urban Institute

Maryland imposes the lowest top rate at 10 percent.

. Until this estate tax is phased. There is no inheritance tax in Tennessee. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

There are NO Tennessee Inheritance Tax. Use e-Signature Secure Your Files. Tennessee estate tax.

Try it for Free Now. All inheritance are exempt in the State of Tennessee. Of the six states with inheritance taxes Kentucky and New Jersey have the highest top rates at 16 percent.

Any amount gifted to one person over that limit counts against your. In fact it doesnt matter the size of your estate there will be no state level tax. Tennessee is an inheritance tax and estate tax-free state.

Those who handle your estate following your death though do have some other tax returns to take care of such as. However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax. Tennessee does not have an inheritance tax either.

Connecticuts estate tax will have a flat rate of 12. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

Estate taxes are paid by the decedents estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. As of December 31 2015 the inheritance tax was eliminated in Tennessee.

If the total Estate asset property cash etc is over 5430000 it is subject to the. Upload Modify or Create Forms. This is great news for residence.

Inheritance taxes are remitted by the. If the total Estate asset property cash etc. Inheritance taxes are remitted by the.

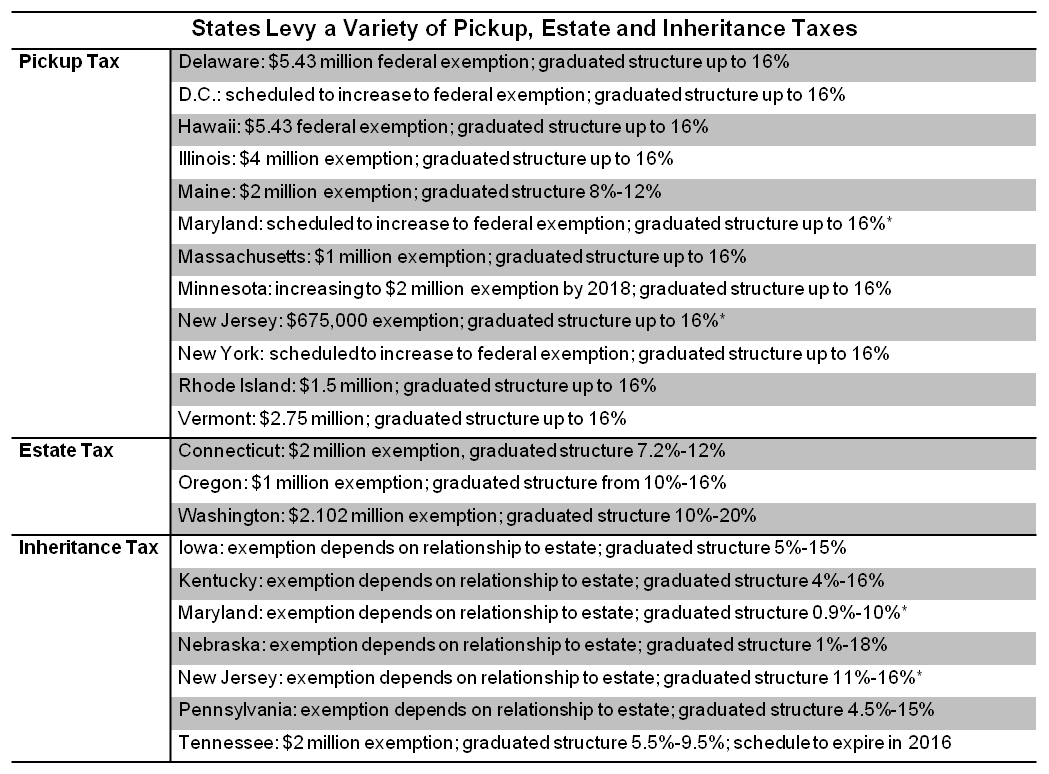

Inheritance taxes in Tennessee. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. There are NO Tennessee Inheritance Tax.

Estate taxes are paid by the decedents estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. How does inheritance tax work in Tennessee. All inheritance are exempt in the State of Tennessee.

The exemption is 117. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any.

State Estate And Inheritance Taxes Itep

State By State Estate And Inheritance Tax Rates Everplans

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

What Is An Inheritance Tax And Do I Have To Pay It Ramsey

State Estate And Inheritance Taxes In 2014 Tax Foundation

Does Kansas Charge An Inheritance Tax

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee Tax Resolution Options For Back Taxes Owed

11 Estate Taxes And Inheritance Planning Faqs Taxact Blog

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina S Estate Tax Dying Out Estate And Elder Law Blog Estate And Elder Law Lexisnexis Legal Newsroom

Form 302 Tn Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

Affidavit To Waive Filing Of Tennessee Inheritance Tax Return 007 Pdf Fpdf Doc

Here Are The States With No Estate Or Inheritance Taxes

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Reinstating Kentucky S Tax On Extreme Wealth A Part Of Making State Taxes Fair And Adequate Kentucky Center For Economic Policy

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)